Project Description

Property buyers often have to use various factors to determine which property to buy/invest in. There is also no certainty if the price of the property will increase in the next few years.

Objectives

- Come up with a model to predict property prices, backed by data

- Identifying factors that affects the prices of property

- Predict future prices accurately, up to 10 years

Objectives

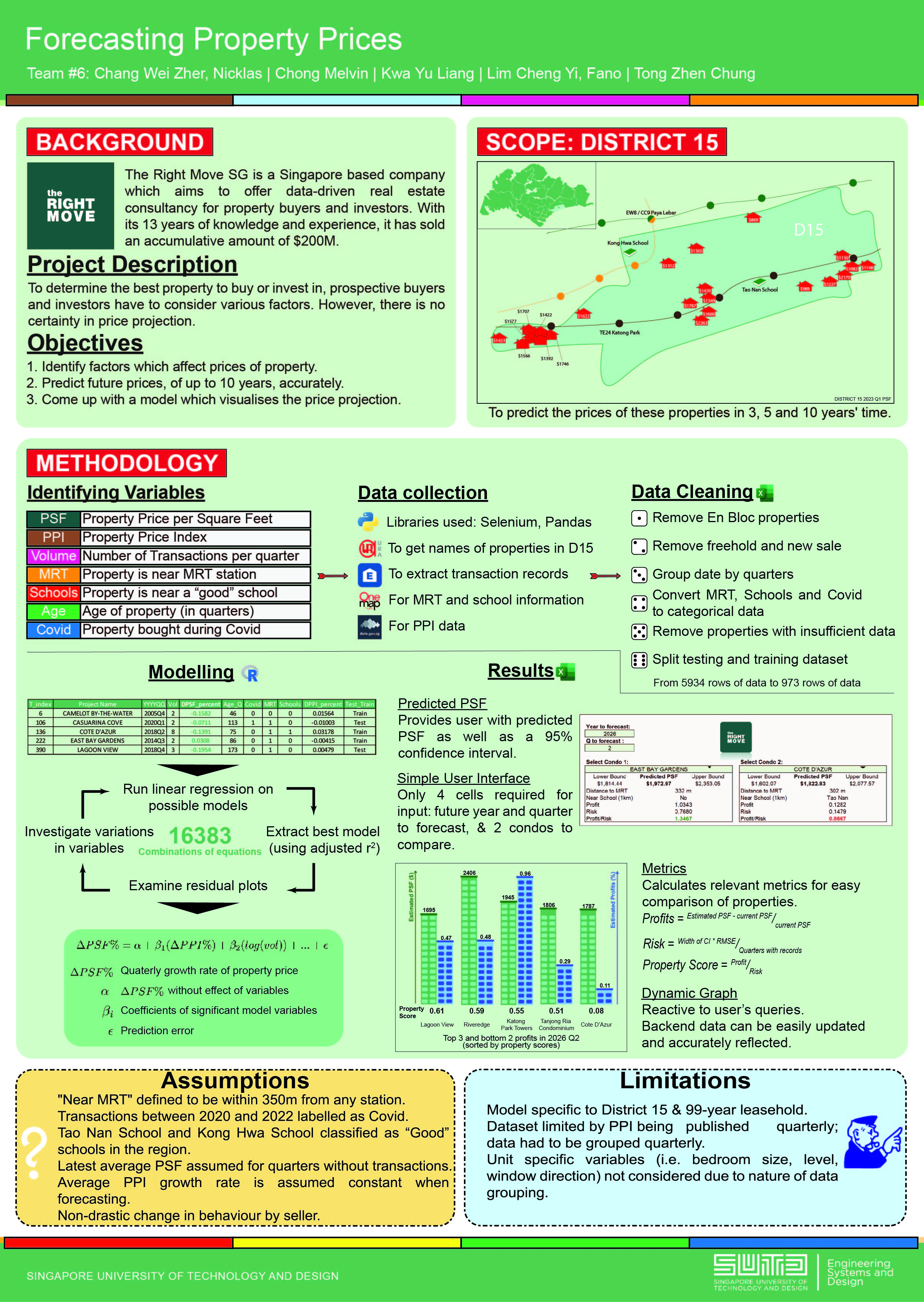

- Identifying Variables: PSF, PPI, Volume, MRT, Schools, Age, Covid

- webscraping.ipyn: webscrape property transaction data from Edgeprop

- MRT and school scrape.ipyn, onemap scraper.ipyn: webscrape MRT and school data from OneMap

Data Cleaning

ModelDB grp by.xlsx in Raw Data folder

Modelling

Iterative process looping through:

- Run linear regression on possible models

- Extract best model (using adjusted r^2)

- Examine residual plots

- Investigate variations of variables

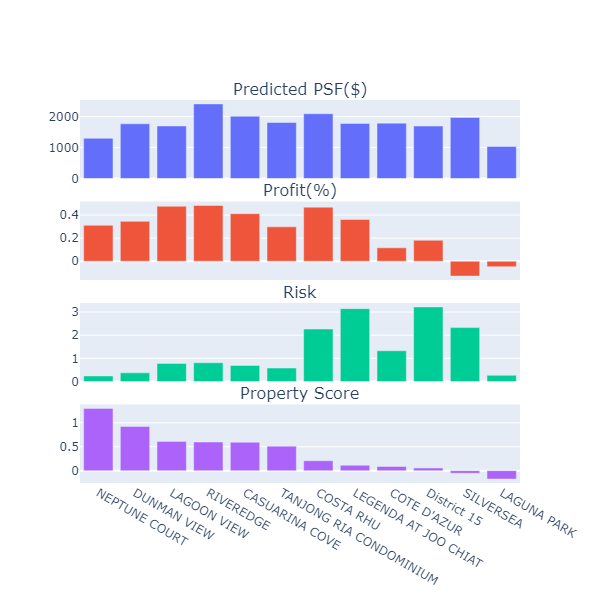

Results

Assumptions

- Near MRT" defined to be within 350m from any station

- Transactions between 2020 and 2022 labelled as Covid

- Tao Nan School and Kong Hwa School classified as "Good" schools in the region

- Latest average PSF assumed for quarters without transactions

- Average PPI growth rate is assumed constant when forecasting

- Non-drastic change in behaviour by seller

Limitations

- Model specific to District 15 & 99-year leasehold

- Dataset limited by PPI being published quarterly; data had to be grouped quarterly

- Unit specific variables (i.e. bedroom size, level, window direction) not considered due to nature of data grouping

Tools Used

Python

Pandas

Selenium

R

HTML

GIT

Web Scraping

Math Modelling

Consulting